Latest News

Hybrid L2 Build on Bitcoin Launches Mainnet; US Users Face Geo-Blocking

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]Zksnacks to Cease Coinjoin Transactions, Affecting Wasabi, Trezor and Btcpay

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]

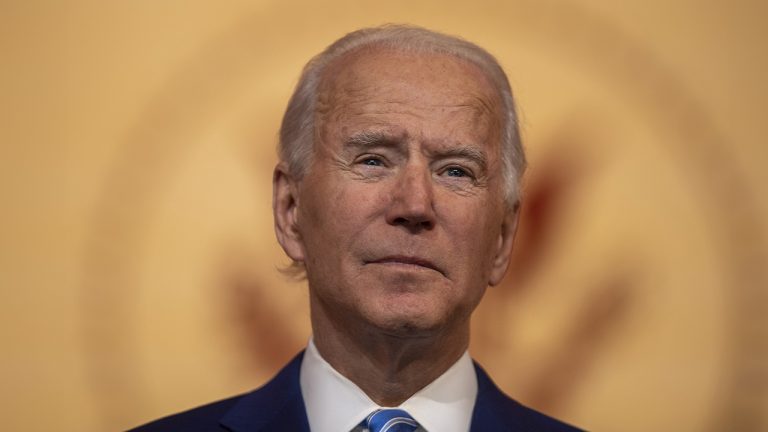

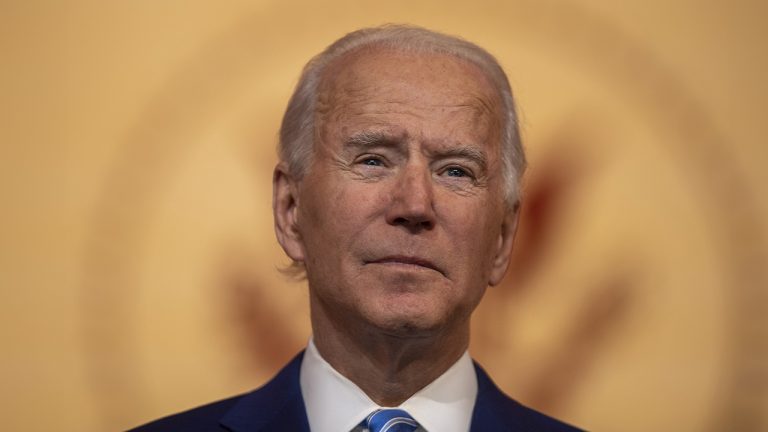

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]Messari CEO Criticizes US President’s Crypto Stance, Foresees ‘Mass Wealth Confiscation’ if Biden Gets Reelected

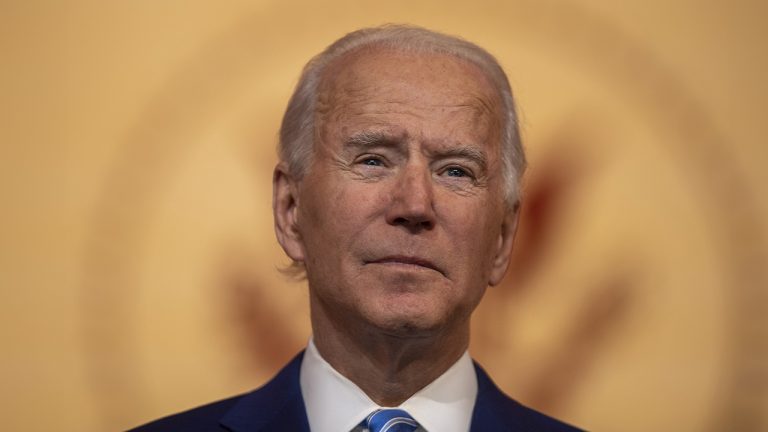

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]Coinbase Announces Support for Bitcoin’s Lightning Network

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]

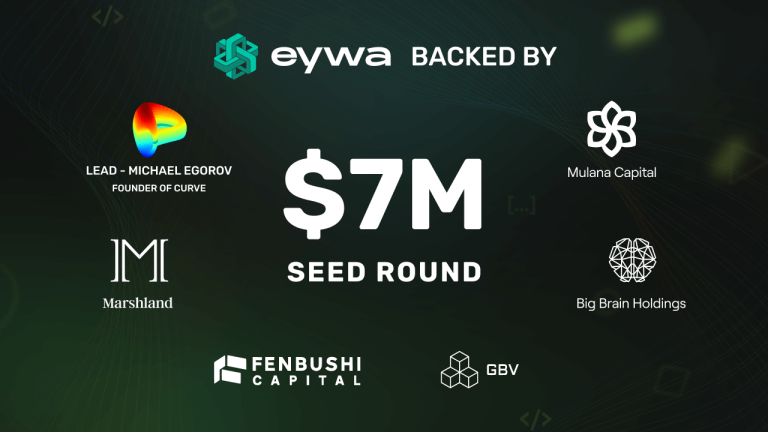

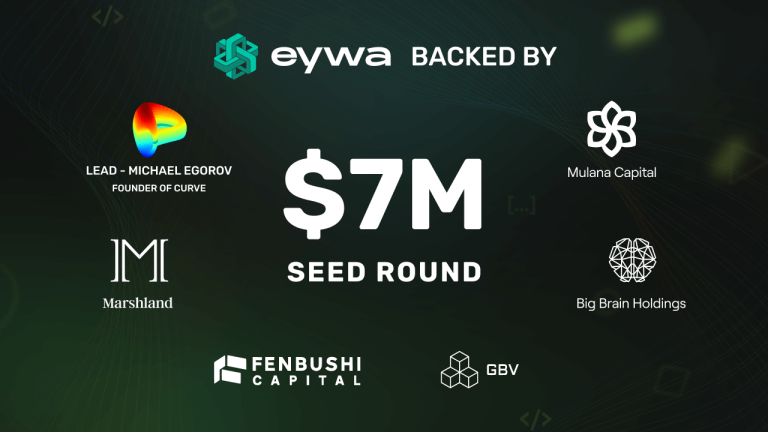

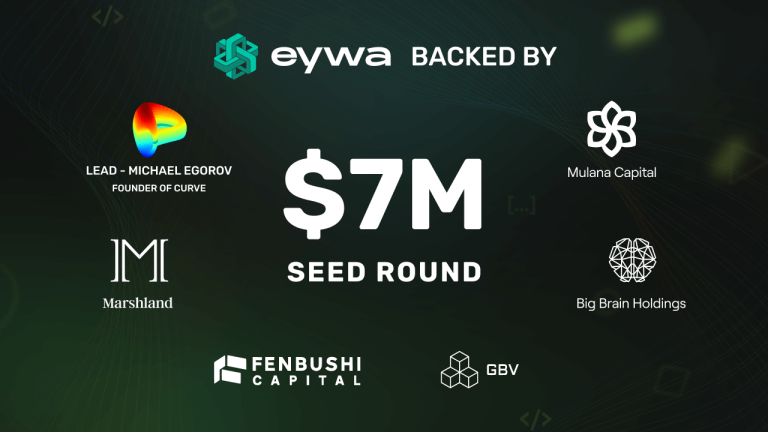

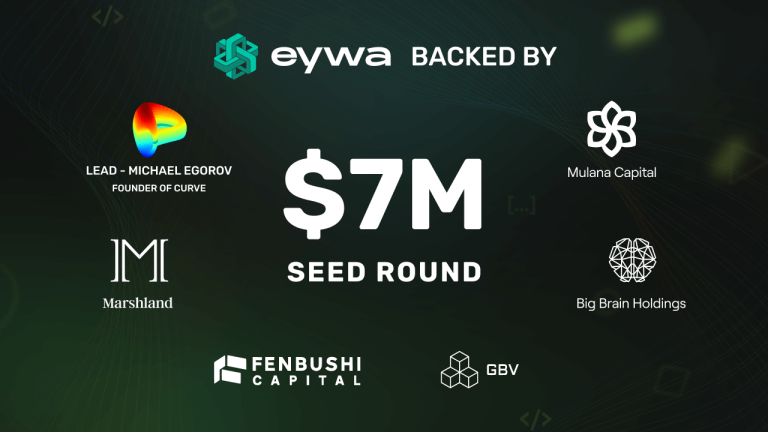

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]Top VCs Join EYWA’s Seed Round Led by Curve’s Founder

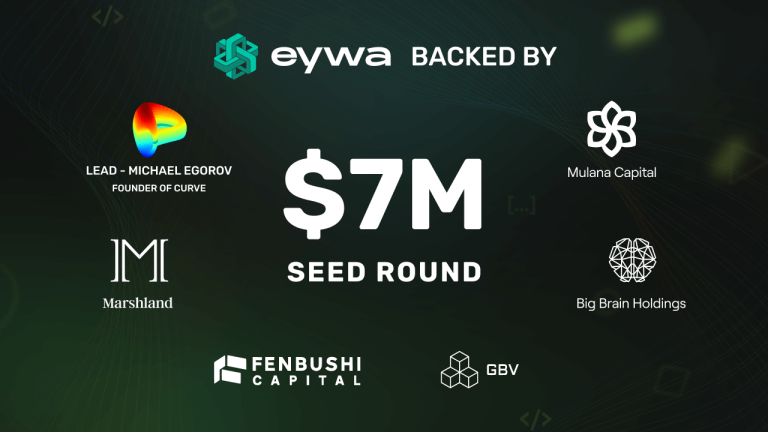

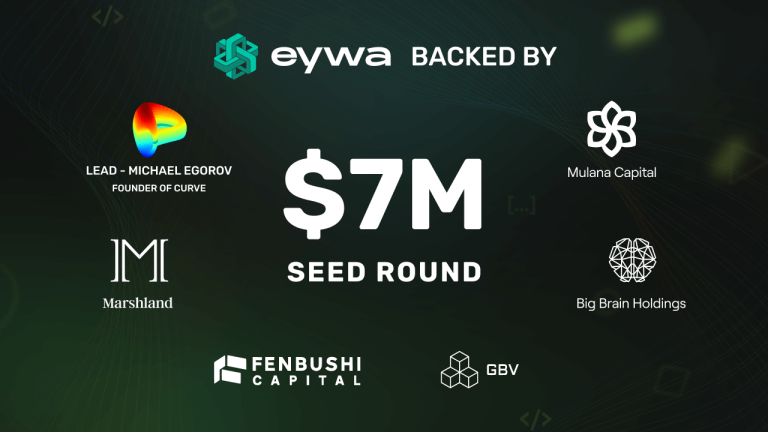

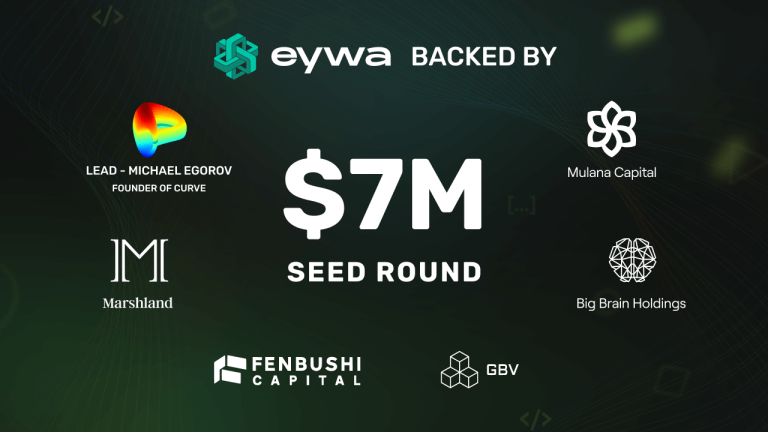

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]Lightspark CEO Expects Bitcoin to Dominate AI-Related Monetary Transactions

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]Fidelity Digital Assets Study: Bitcoin’s Volatility Declines as It Grows, Echoing Historical Asset Trends

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]Record Withdrawal From US Bitcoin ETFs Marks Largest Single-Day Outflow

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]Faisal Al Monai: Convergence of AI and Blockchain Is a Solution to Data Integrity Issues in AI Model Training

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]Attackers Steal $1.6 Million in Digital Assets From Defi Protocol Pike Finance

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]Bitcoin Slump Pushes New Whales Underwater: A Rare Opportunity To Buy?

Crypto Analyst Says Bitcoin Must Hold Above $51,800 As ETF Outflows Trigger Crash

Bitcoin On Track For $1 Million Per BTC “Fair Value”, Analyst Says

Bitcoin Déjà Vu: Analyst Identifies Trends Reflecting 2016 Cycle

Ripple Unlocks 1 Billion XRP From Escrow – How Will This Impact Price?

Crypto Analyst Predicts 244% Shiba Inu Rally Based On Bull Flag

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Fresh Money From Retail Traders Flows Into Copy Trading As Crypto Derivative Expands: Margex Report

Bitcoin Bull Run Over? Analyst Predicts What To Expect Now

Bitcoin Slide Over? Top Analysts Unanimously Call $56,000 The Bottom

Hybrid L2 Build on Bitcoin Launches Mainnet; US Users Face Geo-Blocking

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]Zksnacks to Cease Coinjoin Transactions, Affecting Wasabi, Trezor and Btcpay

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]Messari CEO Criticizes US President’s Crypto Stance, Foresees ‘Mass Wealth Confiscation’ if Biden Gets Reelected

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]Coinbase Announces Support for Bitcoin’s Lightning Network

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]Top VCs Join EYWA’s Seed Round Led by Curve’s Founder

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]Lightspark CEO Expects Bitcoin to Dominate AI-Related Monetary Transactions

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]Fidelity Digital Assets Study: Bitcoin’s Volatility Declines as It Grows, Echoing Historical Asset Trends

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]Record Withdrawal From US Bitcoin ETFs Marks Largest Single-Day Outflow

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]Faisal Al Monai: Convergence of AI and Blockchain Is a Solution to Data Integrity Issues in AI Model Training

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]Attackers Steal $1.6 Million in Digital Assets From Defi Protocol Pike Finance

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]Chainalysis will help Tether monitor secondary market for illicit activity

The blockchain analytics firm will provide tools to spot sanctioned and illicit activity and provide market information.

US lawmakers warn of Iranian crypto miners threatening national security

According to Senators Elizabeth Warren and Angus King, the Iranian government has used funds from crypto mining to fund terrorist organizations.

Binance Wallet announces support for Bitcoin Atomical ARC-20 assets

The Atomicals protocol provides a transparent, secure record of ownership and history for Bitcoin NFTs.

US lawmakers urge SEC to approve Bitcoin options trading

Representatives Mike Flood and Wiley Nickel urged the SEC's chair Gary Gensler to stop discriminating against Bitcoin funds in a letter.

Here’s what happened in crypto today

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Analysts expect Bitcoin price recovery after Fed leaves rates unchanged

Bitcoin price shows signs of a recovery, but analysts are uncertain whether the strongest part of the correction has passed.

Pantera invests in TON with high expectations for Telegram’s future

The Telegram-TON hookup opens up a broad spectrum of Web3 opportunities for Telegram’s 900 million monthly users, Pantera Capital said.

‘Mr. 100’ buys the Bitcoin dip for the first time since halving — Is the BTC bottom in?

Mr. 100, an entity previously identified as Upbit, has bought over $147 million worth of Bitcoin for the first time since the halving, suggesting an end to the current retracement.

Nigerian court postpones money laundering trial of Binance and execs

A judge in Nigeria reportedly adjourned proceedings in a case against Binance and two executives until May 17 to allow lawyers to review certain documents.

Pickup artists using AI, deep fake nudes outlawed, Rabbit R1 fail: AI Eye

Deep fake nudes to be outlawed in UK and Australia, pick up artists fake big live stream audiences to meet women, plus more news: AI Eye.

Bitcoin price correction ‘very common’ if $56K lows hold — Peter Brandt

Bitcoin bulls see signs of the worst being over as a BTC price bounce gathers pace toward $60,000.

Binance ties SAFU fund to USDC: Is the fund missing out on potential gains?

Binance has exchanged a diversified $1 billion crypto portfolio in SAFU funds into USD Coin.

Why is Solana (SOL) price up today?

Today, the price of Solana has risen, propelled by a series of positive announcements related to the network and the Fed's decision to forego rate hikes in 2024.

Nasdaq-listed mining firm Stronghold Digital Mining for sale?

Stronghold announced its first quarter results for 2024 and revealed that it is considering a range of options to increase shareholder value including selling the business.

MoonPay expands crypto options with PayPal integration

MoonPay users in the U.S. can now buy and sell 110 different cryptocurrencies using PayPal transfers via wallet, bank transfers or debit cards.

Stacks active accounts reach record high amid growing interest in Bitcoin DeFi

The growing interest in Runes and Bitcoin DeFi will drive more activity to layer-2 networks, according to Stacks’ product manager.

Friend​.tech v2 airdrop could introduce nontransferable token

Making the token nontransferable could force users to pay the 1.5% Friend.tech platform fee in an “ironic†shift from the platform’s non-venture capitalist approach.

How to short Bitcoin on Binance and Coinbase

Shorting Bitcoin on Binance and Coinbase is akin to a high-stakes gamble where mastering margin trading and futures contracts is key to tilting the odds in your favor.

Hundred Finance hacker moves stolen assets a year after $7M exploit

The hacker holds about $4.3 million in various crypto assets in their Ethereum wallet.

Bitcoin post-halving price consolidation could last 2 months — Bitfinex

The Bitcoin halving is widely expected to have a positive impact on the price of the preeminent cryptocurrency, but analysts expect volatile price consolidation in the short term.

Hong Kong Bitcoin ETFs not enough to absorb US ETF selling pressure

Despite the excitement around the Hong Kong ETF debut, the inflows are only a fraction of the outflows from U.S. ETFs. Could the Bitcoin price revisit the $50,000 mark next?

Microsoft pours $2.2B into Malaysia for cloud, AI expansion

In a statement, Microsoft said it will collaborate with the Malaysian government to establish a “national AI Center of Excellence†and improve cybersecurity capabilities.

Indian enforcement agency collaborates with Binance to bust scam app

The law enforcement agency managed to track the funds linked to the E-Nugget scam app to different crypto exchanges and, with their help, seized over $10.5 million in crypto assets.

LayerZero cross-chain interoperability protocol completes first airdrop snapshot

LayerZero’s ZRO perpetual futures contract is trading at $8.6 on Hyperliquid, the world’s largest perps DEX, suggesting a potential $17 billion fully diluted valuation.

Bitcoin dumps 'bull market excess' as daily ETF outflows pass $500M

BTC price action spooks ETF investors, data shows, but there is reason to believe that Bitcoin is seeing a broadly healthy correction.

Bitcoin halving sees Bitfarms’ BTC mining earnings plummet

Bitfarms is actively working to triple its current hash rate capacity to 21 exahashes per second with a $240 million investment.

FBI busts $43M crypto and Las Vegas hospitality Ponzi scheme

The FBI arrested a New York resident for defrauding investors of at least $43 million in a multi-year Ponzi scheme that included a Las Vegas hospitality business and crypto trading operation.

Pike Finance clarifies ‘USDC vulnerability’ statement on $1.6M exploit

Pike highlighted that the exploit occurred due to their team’s inadequate integration of third-party technologies such as the CCTP or Gelato Network’s automation services.

Nigeria’s Patricia exchange CEO refutes closure rumors

Patricia came under scrutiny following a hacking incident in May 2023, which led to a significant loss of customer funds.

Arkansas bills reining in crypto miners head for governor approval

Arkansas Governor Sarah Huckabee Sanders is expected to sign the bills into law, which will regulate miners’ noise, water use and licensing.

Bitcoin Slump Pushes New Whales Underwater: A Rare Opportunity To Buy?

Crypto Analyst Says Bitcoin Must Hold Above $51,800 As ETF Outflows Trigger Crash

Bitcoin On Track For $1 Million Per BTC “Fair Value”, Analyst Says

Bitcoin Déjà Vu: Analyst Identifies Trends Reflecting 2016 Cycle

Ripple Unlocks 1 Billion XRP From Escrow – How Will This Impact Price?

Crypto Analyst Predicts 244% Shiba Inu Rally Based On Bull Flag

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Fresh Money From Retail Traders Flows Into Copy Trading As Crypto Derivative Expands: Margex Report

Bitcoin Bull Run Over? Analyst Predicts What To Expect Now

Bitcoin Slide Over? Top Analysts Unanimously Call $56,000 The Bottom

Hybrid L2 Build on Bitcoin Launches Mainnet; US Users Face Geo-Blocking

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]Zksnacks to Cease Coinjoin Transactions, Affecting Wasabi, Trezor and Btcpay

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]Messari CEO Criticizes US President’s Crypto Stance, Foresees ‘Mass Wealth Confiscation’ if Biden Gets Reelected

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]Coinbase Announces Support for Bitcoin’s Lightning Network

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]Top VCs Join EYWA’s Seed Round Led by Curve’s Founder

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]Lightspark CEO Expects Bitcoin to Dominate AI-Related Monetary Transactions

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]Fidelity Digital Assets Study: Bitcoin’s Volatility Declines as It Grows, Echoing Historical Asset Trends

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]Record Withdrawal From US Bitcoin ETFs Marks Largest Single-Day Outflow

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]Faisal Al Monai: Convergence of AI and Blockchain Is a Solution to Data Integrity Issues in AI Model Training

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]Attackers Steal $1.6 Million in Digital Assets From Defi Protocol Pike Finance

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]Top 5 Bitcoin ATM Locations in Athens for Fast and Easy Crypto Access

As a crypto analyst and frequent investor in the Greek digital currency market, I can confidently recommend Bcash for convenient and secure Bitcoin purchasing in Athens. With 10 strategically located crypto ATM hotspots spanning central Athens and the northern suburbs, Bcash enables instant access to leading cryptocurrencies like BTC, ETH, and USDT. Experience the Leading […]

The post Top 5 Bitcoin ATM Locations in Athens for Fast and Easy Crypto Access appeared first on CryptoNinjas.

Bitwise launching spot bitcoin ETF (BITB)

Bitwise Asset Management, the largest crypto index fund manager in America, announced today that the Bitwise Bitcoin ETF (BITB), the firm’s first spot bitcoin ETF, intends to begin trading today, January 11th. BITB will join Bitwise’s comprehensive suite of 18 crypto investment products, which currently includes five other crypto ETFs. “We expect significant demand for […]

The post Bitwise launching spot bitcoin ETF (BITB) appeared first on CryptoNinjas.

Cryptocurrency Payments for Insurance: Are Insurance Companies Really Embracing Bitcoin and Altcoins?

It is no longer unusual to hear that a bank accepts savings in Bitcoin, Ethereum, and the like. Or that a loan company helps businesses with crypto. After all, the traditional financial and insurance industries were among the first to adopt cryptocurrencies. The latter ones have found more than one way to incorporate these means of payment […]

The post Cryptocurrency Payments for Insurance: Are Insurance Companies Really Embracing Bitcoin and Altcoins? appeared first on CryptoNinjas.

4 Things We’ve Learned About Owning Bitcoin in 2023

For some people, the word bitcoin still triggers an eye-roll, but by now, most of us know that cryptocurrency is here to stay. With that in mind, it’s a good idea to make sure you’re clued up and well-educated on the topic, especially if you’ve ever considered investing yourself. However, with so much misinformation floating […]

The post 4 Things We’ve Learned About Owning Bitcoin in 2023 appeared first on CryptoNinjas.

Fuse Network welcomes Liquify as new blockchain infrastructure partner

Today, Fuse Network, an enterprise-grade, use-case agnostic, decentralized EVM-compatible public blockchain, announced Liquify as its newest remote procedure call (RPC) provider and ecosystem partner. Liquify will provide public RPC services – both free and private. RPC nodes help process requests from decentralized applications (dApps). They are vital for improving the usability of web3 and for […]

The post Fuse Network welcomes Liquify as new blockchain infrastructure partner appeared first on CryptoNinjas.

BITmarkets – Spot, Futures, Margin Trading with 150+ Cryptocurrencies

Welcome to the world of BITmarkets – a leading cryptocurrency exchange offering a wide range of trading options for both retail traders and corporate clients. In this comprehensive review, we will explore the various features and services provided by BITmarkets, including spot, futures, and margin trading. Whether a seasoned trader or just starting your cryptocurrency […]

The post BITmarkets – Spot, Futures, Margin Trading with 150+ Cryptocurrencies appeared first on CryptoNinjas.

Hong Kong’s first licensed crypto exchange HashKey is now live

HashKey Exchange, the first licensed retail virtual asset exchange registered in Hong Kong, announced its official launch today. Together with executives from the HKSAR government, top-tier banks, insurers, and Big 4 auditing firms, HashKey held the grand launch in Hong Kong. Strictly adhering to the SFC’s user registration and KYC requirements, the HashKey Exchange platform […]

The post Hong Kong’s first licensed crypto exchange HashKey is now live appeared first on CryptoNinjas.

Adenasoft launches new crypto exchange white label solution: ACE

Adenasoft, a South Korea-based IT/software company, has just announced the launch of ACE, their new SaaS product designed for cryptocurrency exchanges. ACE fully prepares businesses for exchange operations quickly, taking less than a month to get up and running. ACE offers a comprehensive suite of features that enables crypto exchanges to streamline their operations and […]

The post Adenasoft launches new crypto exchange white label solution: ACE appeared first on CryptoNinjas.

Maximize Your ETH Investment: The ETHphoria Vault by Pods

This week, the team of Pods, a provider of structured products for crypto assets, unveiled its latest offering – the ETHphoria Vault. This innovative yield strategy is designed explicitly for ETH enthusiasts who are bullish about its future prospects and want to earn even more from increasing prices. ETHphoria is a low-risk, principal-protected strategy designed […]

The post Maximize Your ETH Investment: The ETHphoria Vault by Pods appeared first on CryptoNinjas.

Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet

The team of Pods recently announced the mainnet launch of its 3rd strategy on Pods Yield: FUD Vault, which now complements ETHphoria and stETHvv. FUD Vault provides a way for users to benefit from market downturns by offering a mechanism to hedge against significant price drops in ETH while preserving the deposited principal. Who is […]

The post Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet appeared first on CryptoNinjas.

What is DeFi Returns? A new way of DeFi Investing

DeFi Returns brings comprehensive up-to-date information on DeFi strategies and protocols, to easily compare and analyze their performance. Getting the most reliable data source for historical yield on DeFi, to help users make informed decisions when investing in the ecosystem. All data displayed is sourced from the protocol’s smart contracts directly. The new DeFi Returns […]

The post What is DeFi Returns? A new way of DeFi Investing appeared first on CryptoNinjas.

RockX broadens suite with launch of new ether (ETH) native staking solution

RockX, an Asia-based institutional-grade staking services provider, announced today the broadening of its staking product suite with the addition of a new ether (ETH) native staking solution. This latest offering strengthens RockX’s position as a comprehensive provider of diverse staking needs, maneuvering quickly to the evolving crypto market landscape. Navigating the Ethereum ecosystem presents institutions with […]

The post RockX broadens suite with launch of new ether (ETH) native staking solution appeared first on CryptoNinjas.

The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets

Hex Trust, a regulated institutional-grade crypto-asset custodian, today announced it has partnered with The Sandbox, a leading decentralized gaming virtual world to enable fully-licensed and highly-secure custody of assets such as LAND in The Sandbox’s metaverse. The partnership sees Hex Trust fully integrate LAND into its custody platform, Hex Safe, which supports cryptocurrencies, security tokens, and NFTs. […]

The post The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets appeared first on CryptoNinjas.

CoinFlip launches new self-custodial cryptocurrency wallet platform ‘Olliv’

CoinFlip, a bitcoin ATM and crypto services company, announced today a new offering with the launch of ‘Olliv,’ a self-custody-powered crypto platform. The Olliv platform provides a frictionless way to buy, sell, send, receive, and swap cryptocurrency securely stored on a self-custodial wallet, removing the uncertainty of unknown third-party custodians. By leveraging CoinFlip’s existing network […]

The post CoinFlip launches new self-custodial cryptocurrency wallet platform ‘Olliv’ appeared first on CryptoNinjas.

Crypto derivatives exchange Deribit to launch zero-fee spot trading

Deribit, a popular cryptocurrency derivatives platform, has announced the launch of zero-fee spot trading, allowing clients to buy and sell crypto while simultaneously managing risk using other derivatives. Spot trading will start on April, 24th 2023 at 1 PM UTC with three pairs (BTC/USDC, ETH/USDC, and ETH/BTC), providing clients with a simple and free solution […]

The post Crypto derivatives exchange Deribit to launch zero-fee spot trading appeared first on CryptoNinjas.

Nomura’s Laser Digital invests in Infinity, an Ethereum-based money market protocol

Japan-based banking giant Nomura, announced today that its digital assets subsidiary, Laser Digital, has made a strategic investment in Infinity, a non-custodial interest rate protocol built on Ethereum. Infinity’s wholesale exchange, the first of several planned infrastructures, provides inter-exchange clearing, fixed and floating rate markets, as well as enterprise-grade risk management utilizing hybrid on-chain/off-chain infrastructures […]

The post Nomura’s Laser Digital invests in Infinity, an Ethereum-based money market protocol appeared first on CryptoNinjas.

ETH infrastructure platform Blocknative adds TX bundles, cancellation, and replacement support

Blocknative, a real-time Ethereum (ETH) infrastructure platform, has newly introduced features including transaction bundle send, cancellation, and replacement support for the Blocknative Builder. Searchers can now submit MEV bundles privately to the Blocknative Builder to be included on-chain. This market utility builds upon Blocknative’s reliable, real-time infrastructure that is systematically important to the Ethereum ecosystem. […]

The post ETH infrastructure platform Blocknative adds TX bundles, cancellation, and replacement support appeared first on CryptoNinjas.

Crypto derivatives exchange Deribit to put in place trade surveillance platform from Eventus

Eventus, a provider of multi-asset class trade surveillance and market risk solutions, announced today that cryptocurrency derivatives exchange Deribit has chosen the firm’s Validus platform to provide market abuse monitoring on the exchange. Headquartered in Panama City, Panama, Deribit is one of the largest cryptocurrency options exchanges by volume and open interest, with approximately 90% […]

The post Crypto derivatives exchange Deribit to put in place trade surveillance platform from Eventus appeared first on CryptoNinjas.

Crypto exchange Gemini launches new electronic OTC trading solution

Gemini, the popular bitcoin & crypto exchange company, today announced the launch of electronic over-the-counter trading (eOTC), an automated crypto trading solution designed for institutions. The Gemini eOTC solution offers a variety of advantages to institutional traders including: Competitive Pricing & Execution: Liquidity is sourced from top-tier liquidity providers with deep liquidity pools, enabling counterparties […]

The post Crypto exchange Gemini launches new electronic OTC trading solution appeared first on CryptoNinjas.

Crypto securitization platform GenTwo links to all Coinbase assets

GenTwo Digital, the crypto-asset securitization platform based out of Crypto Valley in Zug, Switzerland, today announced a partnership with Coinbase, the publicly-listed cryptocurrency platform. This new partnership for GenTwo Digital allows all Coinbase crypto assets to be wrapped in bankable financial investment products and enables financial intermediaries to issue certificates such AMCs (Actively Management Certificates). […]

The post Crypto securitization platform GenTwo links to all Coinbase assets appeared first on CryptoNinjas.

Blockchain ecosystem ThunderCore teams with Huobi and MyCointainer in node expansion

ThunderCore, a leading blockchain & web3 ecosystem announced today that they are making a new development push, partnering with new validators as the chain rolls out its new crypto staking model. The newest ThunderCore validators include the famous crypto-asset exchange Huobi and one of the earliest staking platforms in the space, MyCointainer. Users of both […]

The post Blockchain ecosystem ThunderCore teams with Huobi and MyCointainer in node expansion appeared first on CryptoNinjas.

DeFi protocol Pods raises $5.6M to support its structured crypto products dApp

Pods, creators of a DeFi platform, announced today that earlier this year, the team raised $5.6M in seed funding to create structured products for crypto-assets. The financing featured investors such as IOSG, Tomahawk, Republic, Framework Ventures, and more. The first strategy on Pods Yield is stETHvv (Ethereum Volatility Vault). stETHvv is a low-risk product focused […]

The post DeFi protocol Pods raises $5.6M to support its structured crypto products dApp appeared first on CryptoNinjas.

Crypto derivatives exchange Deribit releases new client verification of assets tool

Deribit, the popular cryptocurrency derivatives exchange, announced today it has launched a new ‘Proof of Reserves‘ tool for clients using the trading platform. Now, clients are provided with the functionality to verify their assets to be included in Deribit’s overall reserves. How it Works Deribit provides all addresses for all on-chain assets and it delivers […]

The post Crypto derivatives exchange Deribit releases new client verification of assets tool appeared first on CryptoNinjas.

Tenderly introduces TXN simulations on its blockchain gateway for efficient dApp development

Tenderly, creators of a blockchain development platform, today announced that it is the first web3 development platform to offer simulations through RPC on its Tenderly Web3 Gateway, the company’s production node as a service. Note, Tenderly already processes more than 50 million simulations per month through its Transaction Simulator. Now, the company is introducing the […]

The post Tenderly introduces TXN simulations on its blockchain gateway for efficient dApp development appeared first on CryptoNinjas.

DFINITY brings new smart contract functionality to Bitcoin with Internet Computer integration

DFINITY Foundation, the not-for-profit organization contributing to the development of the Internet Computer (IC) — a high-speed, internet-scale public blockchain — has announced today the Internet Computer’s mainnet integration with Bitcoin, bringing smart contract functionality to the cryptocurrency. Now, the Internet Computer can serve as a layer-2 for Bitcoin where smart contracts on the Internet […]

The post DFINITY brings new smart contract functionality to Bitcoin with Internet Computer integration appeared first on CryptoNinjas.

Chainalysis will help Tether monitor secondary market for illicit activity

The blockchain analytics firm will provide tools to spot sanctioned and illicit activity and provide market information.

US lawmakers warn of Iranian crypto miners threatening national security

According to Senators Elizabeth Warren and Angus King, the Iranian government has used funds from crypto mining to fund terrorist organizations.

Binance Wallet announces support for Bitcoin Atomical ARC-20 assets

The Atomicals protocol provides a transparent, secure record of ownership and history for Bitcoin NFTs.

US lawmakers urge SEC to approve Bitcoin options trading

Representatives Mike Flood and Wiley Nickel urged the SEC's chair Gary Gensler to stop discriminating against Bitcoin funds in a letter.

Here’s what happened in crypto today

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

Analysts expect Bitcoin price recovery after Fed leaves rates unchanged

Bitcoin price shows signs of a recovery, but analysts are uncertain whether the strongest part of the correction has passed.

Pantera invests in TON with high expectations for Telegram’s future

The Telegram-TON hookup opens up a broad spectrum of Web3 opportunities for Telegram’s 900 million monthly users, Pantera Capital said.

‘Mr. 100’ buys the Bitcoin dip for the first time since halving — Is the BTC bottom in?

Mr. 100, an entity previously identified as Upbit, has bought over $147 million worth of Bitcoin for the first time since the halving, suggesting an end to the current retracement.

Nigerian court postpones money laundering trial of Binance and execs

A judge in Nigeria reportedly adjourned proceedings in a case against Binance and two executives until May 17 to allow lawyers to review certain documents.

Pickup artists using AI, deep fake nudes outlawed, Rabbit R1 fail: AI Eye

Deep fake nudes to be outlawed in UK and Australia, pick up artists fake big live stream audiences to meet women, plus more news: AI Eye.

Bitcoin price correction ‘very common’ if $56K lows hold — Peter Brandt

Bitcoin bulls see signs of the worst being over as a BTC price bounce gathers pace toward $60,000.

Binance ties SAFU fund to USDC: Is the fund missing out on potential gains?

Binance has exchanged a diversified $1 billion crypto portfolio in SAFU funds into USD Coin.

Why is Solana (SOL) price up today?

Today, the price of Solana has risen, propelled by a series of positive announcements related to the network and the Fed's decision to forego rate hikes in 2024.

Nasdaq-listed mining firm Stronghold Digital Mining for sale?

Stronghold announced its first quarter results for 2024 and revealed that it is considering a range of options to increase shareholder value including selling the business.

MoonPay expands crypto options with PayPal integration

MoonPay users in the U.S. can now buy and sell 110 different cryptocurrencies using PayPal transfers via wallet, bank transfers or debit cards.

Stacks active accounts reach record high amid growing interest in Bitcoin DeFi

The growing interest in Runes and Bitcoin DeFi will drive more activity to layer-2 networks, according to Stacks’ product manager.

Friend​.tech v2 airdrop could introduce nontransferable token

Making the token nontransferable could force users to pay the 1.5% Friend.tech platform fee in an “ironic†shift from the platform’s non-venture capitalist approach.

How to short Bitcoin on Binance and Coinbase

Shorting Bitcoin on Binance and Coinbase is akin to a high-stakes gamble where mastering margin trading and futures contracts is key to tilting the odds in your favor.

Hundred Finance hacker moves stolen assets a year after $7M exploit

The hacker holds about $4.3 million in various crypto assets in their Ethereum wallet.

Bitcoin post-halving price consolidation could last 2 months — Bitfinex

The Bitcoin halving is widely expected to have a positive impact on the price of the preeminent cryptocurrency, but analysts expect volatile price consolidation in the short term.

Hong Kong Bitcoin ETFs not enough to absorb US ETF selling pressure

Despite the excitement around the Hong Kong ETF debut, the inflows are only a fraction of the outflows from U.S. ETFs. Could the Bitcoin price revisit the $50,000 mark next?

Microsoft pours $2.2B into Malaysia for cloud, AI expansion

In a statement, Microsoft said it will collaborate with the Malaysian government to establish a “national AI Center of Excellence†and improve cybersecurity capabilities.

Indian enforcement agency collaborates with Binance to bust scam app

The law enforcement agency managed to track the funds linked to the E-Nugget scam app to different crypto exchanges and, with their help, seized over $10.5 million in crypto assets.

LayerZero cross-chain interoperability protocol completes first airdrop snapshot

LayerZero’s ZRO perpetual futures contract is trading at $8.6 on Hyperliquid, the world’s largest perps DEX, suggesting a potential $17 billion fully diluted valuation.

Bitcoin dumps 'bull market excess' as daily ETF outflows pass $500M

BTC price action spooks ETF investors, data shows, but there is reason to believe that Bitcoin is seeing a broadly healthy correction.

Bitcoin halving sees Bitfarms’ BTC mining earnings plummet

Bitfarms is actively working to triple its current hash rate capacity to 21 exahashes per second with a $240 million investment.

FBI busts $43M crypto and Las Vegas hospitality Ponzi scheme

The FBI arrested a New York resident for defrauding investors of at least $43 million in a multi-year Ponzi scheme that included a Las Vegas hospitality business and crypto trading operation.

Pike Finance clarifies ‘USDC vulnerability’ statement on $1.6M exploit

Pike highlighted that the exploit occurred due to their team’s inadequate integration of third-party technologies such as the CCTP or Gelato Network’s automation services.

Nigeria’s Patricia exchange CEO refutes closure rumors

Patricia came under scrutiny following a hacking incident in May 2023, which led to a significant loss of customer funds.

Arkansas bills reining in crypto miners head for governor approval

Arkansas Governor Sarah Huckabee Sanders is expected to sign the bills into law, which will regulate miners’ noise, water use and licensing.

Bitcoin Slump Pushes New Whales Underwater: A Rare Opportunity To Buy?

Crypto Analyst Says Bitcoin Must Hold Above $51,800 As ETF Outflows Trigger Crash

Bitcoin On Track For $1 Million Per BTC “Fair Value”, Analyst Says

Bitcoin Déjà Vu: Analyst Identifies Trends Reflecting 2016 Cycle

Ripple Unlocks 1 Billion XRP From Escrow – How Will This Impact Price?

Crypto Analyst Predicts 244% Shiba Inu Rally Based On Bull Flag

Whales Dive In, But Dogecoin Price Sinks 20%: What’s Going On?

Fresh Money From Retail Traders Flows Into Copy Trading As Crypto Derivative Expands: Margex Report

Bitcoin Bull Run Over? Analyst Predicts What To Expect Now

Bitcoin Slide Over? Top Analysts Unanimously Call $56,000 The Bottom

Hybrid L2 Build on Bitcoin Launches Mainnet; US Users Face Geo-Blocking

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]

The layer-two initiative known as BOB, short for ‘Build on Bitcoin,’ has declared its mainnet operational with over 40 apps launching in the initial phase. Notably, the BOB application that facilitates bridging and access to the ecosystem is geo-blocked in the United States. BOB Mainnet Activates, Project Expects a ‘Bitcoin-Driven Defi Summer’ On May 1, […]Zksnacks to Cease Coinjoin Transactions, Affecting Wasabi, Trezor and Btcpay

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]

On Thursday, Zksnacks, the developer behind Wasabi Wallet, announced its decision to cease its coinjoin services following regulatory measures in the U.S. The company stated that the wallet will now operate as a standard non-custodial bitcoin wallet without the coinjoin feature. Zksnacks Withdraws Coinjoin Feature from Wasabi Wallet Following intensified regulatory scrutiny in the U.S., […]Messari CEO Criticizes US President’s Crypto Stance, Foresees ‘Mass Wealth Confiscation’ if Biden Gets Reelected

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]

Recently, Messari’s founder and CEO, Ryan Selkis, has expressed strong opinions about the potential impact of a Joe Biden reelection on the cryptocurrency industry in the United States. On Thursday, Selkis voiced his concerns on the social media platform X, stating that a “second Biden term will lead to mass wealth confiscation and crypto seizures.†[…]Coinbase Announces Support for Bitcoin’s Lightning Network

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]

Coinbase, a leading U.S.-based cryptocurrency exchange, has finally announced the implementation of the lightning network, a Bitcoin layer 2 scaling solution. Coinbase will now allow its users to take advantage of this scaling protocol to avoid paying high fees for Bitcoin transactions, enhancing the utility of crypto for customers using Coinbase’s services. Coinbase Adds Lightning […]Top VCs Join EYWA’s Seed Round Led by Curve’s Founder

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]

PRESS RELEASE. Road Town, British Virgin Islands — May 2, 2024. EYWA, a consensus bridge that secures transactions across multiple protocols, has raised a total of $7 million as it delivers the new era of Web3 interoperability. The investment has been led by Curve Finance founder Michael Egorov — with the project recently attracting two […]Lightspark CEO Expects Bitcoin to Dominate AI-Related Monetary Transactions

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]

David Marcus, the former president of Paypal and the current CEO of Lightspark, envisions bitcoin as the primary currency for artificial intelligence (AI) in the future. He describes bitcoin as “maximally neutral,” highlighting its advantages over conventional fiat currencies like the euro or the U.S. dollar. Bitcoin Poised to Become Default Currency for AI, Says […]Fidelity Digital Assets Study: Bitcoin’s Volatility Declines as It Grows, Echoing Historical Asset Trends

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]

A new study by Fidelity Digital Assets reveals that as bitcoin matures, its volatility is decreasing, making it less volatile than several S&P 500 stocks. “As the asset class matures and its total market cap grows, the inflow of capital is expected to have a smaller impact because it will be flowing into a larger […]Record Withdrawal From US Bitcoin ETFs Marks Largest Single-Day Outflow

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]

On May 1, 2024, U.S. spot bitcoin ETFs experienced their most significant single-day outflows since their inception on Jan. 11, 2024. ETF Institute Co-Founder: ‘Inflows Don’t Go up in a Straight Line’ Data sourced from coinglass.com reveals that these funds saw a withdrawal of $563.7 million on Wednesday, with Fidelity’s FBTC experiencing the highest outflow, […]Faisal Al Monai: Convergence of AI and Blockchain Is a Solution to Data Integrity Issues in AI Model Training

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]

The Middle East and North Africa (MENA) lead the world in the adoption of blockchain and cryptocurrencies because governments in the region actively promote digital transformation in their strategic future visions, according to Faisal Al Monai, chairman and co-founder of Droppgroup. This commitment by governments in the region “creates a favourable environment for the growth […]Attackers Steal $1.6 Million in Digital Assets From Defi Protocol Pike Finance

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]

Unknown attackers recently siphoned digital assets valued at just under $1.6 million from the decentralized finance protocol, Pike Finance. The protocol announced it is offering a 20% reward for the return of the funds, while an ongoing investigation into the incident continues. USDC Vulnerability The decentralized finance (defi) protocol, Pike Finance, said on May 1 […]Bitcoin $6609.990 – CryptoCurrency Trading Report – 24.09.2018 09:08

Hot news: These changes have happened in the last hour.

In the last one hour Bitcoin is leading the record of among the most popular crypto-currency in the trading ecosystem, it has an decrease of -0.33% from its previous value from 6631.875 dollars now at 6609.990 dollars exchange rate. Next to Bitcoin is T..

The post Bitcoin $6609.990 – CryptoCurrency Trading Report – 24.09.2018 09:08 appeared first on CryptoCurrency Blog.

Bitcoin $6668.000 – CryptoCurrency Trading Report – 24.09.2018 08:08

Hot news: The summaries of the last one hour are the followings:

Bitcoin is leading the rank on the most popular crypto-currency, it has an upsurge of 0.12% in its exchange rate, which means 6668.000 dollars from the 6660.008 dollars earlier. Tether is in the second position as Bitcoin leads the first spot. ..

The post Bitcoin $6668.000 – CryptoCurrency Trading Report – 24.09.2018 08:08 appeared first on CryptoCurrency Blog.

Bitcoin $6640.360 – CryptoCurrency Trading Report – 24.09.2018 07:08

Hot news: Here we summon for you the changes of the market of CryptoCurrency from the last 60 minutes.

In the last hour, Bitcoin is leading the cryptocurrency rank. A fall in the exchange rate was seen from 6663.014 dollars to 6640.360 dollars a -0.34% change. Next to Bitcoin is Tether in the second position..

The post Bitcoin $6640.360 – CryptoCurrency Trading Report – 24.09.2018 07:08 appeared first on CryptoCurrency Blog.

Bitcoin $6674.850 – CryptoCurrency Trading Report – 24.09.2018 06:07

Hot news: Here you can read the new CryptoCurrency report of the last 60 Minutes.

Bitcoin is leading the rank in the last hour as the most popular crypto currency in the trade market, with a recorded fall on its value of about -0.12% in the last hour with a current standing rate of 6674.850 dollars from 6682..

The post Bitcoin $6674.850 – CryptoCurrency Trading Report – 24.09.2018 06:07 appeared first on CryptoCurrency Blog.

Bitcoin $6686.310 – CryptoCurrency Trading Report – 24.09.2018 05:07

Hot news: There were a lot of happenings in the last 60 minutes on the Crypto stock exchanges.

Bitcoin is listed as the most popular cryptocurrency in the market. In the last sixty minutes, it had an downswing of -0.19% on its trading price. This means from 6699.038 dollars now at 6686.310 dollars. Tether is..

The post Bitcoin $6686.310 – CryptoCurrency Trading Report – 24.09.2018 05:07 appeared first on CryptoCurrency Blog.

Bitcoin $6704.570 – CryptoCurrency Trading Report – 24.09.2018 04:07

Hot news: Now we show you the newest summary of 60 minutes.

Bitcoin is now leading the rank on the most popular digital currency in the trade market. It has an decrease of -0% in its exchange rate from 6704.570 dollars now at 6704.570 dollars. Bitcoin is seconded by Tether, in a 60 minutes time it has a drop..

The post Bitcoin $6704.570 – CryptoCurrency Trading Report – 24.09.2018 04:07 appeared first on CryptoCurrency Blog.

Bitcoin $6709.350 – CryptoCurrency Trading Report – 24.09.2018 03:07

Hot news: Here we summon for you the changes of the market of CryptoCurrency from the last 60 minutes.

Bitcoin was in the top position in the last hour, the exchange rate decreases from 6710.021 dollars to 6709.350. This is a -0.01% recorded change. Tether is at the second position next to Bitcoin, with a re..

The post Bitcoin $6709.350 – CryptoCurrency Trading Report – 24.09.2018 03:07 appeared first on CryptoCurrency Blog.

Bitcoin $6709.780 – CryptoCurrency Trading Report – 24.09.2018 02:07

Hot news: These changes have happened in the last hour.

Bitcoin was in the top position in the last hour, the exchange rate increases from 6689.711 dollars to 6709.780. This is a 0.3% recorded change. Bitcoin is followed by Tether, with a -0.07% tumble on its trade value in the last one hour, equivalent to 0..

The post Bitcoin $6709.780 – CryptoCurrency Trading Report – 24.09.2018 02:07 appeared first on CryptoCurrency Blog.

Bitcoin $6687.450 – CryptoCurrency Trading Report – 24.09.2018 01:07

Hot news: Here we summon for you the changes of the market of CryptoCurrency from the last 60 minutes.

The number one cryptocurrency leader is Bitcoin, this data was fetched in the last hour. It has an decrease on its trade value to -0.2%, now at 6687.450 dollars from 6700.852. Tether is at the second positi..

The post Bitcoin $6687.450 – CryptoCurrency Trading Report – 24.09.2018 01:07 appeared first on CryptoCurrency Blog.

Bitcoin $6692.560 – CryptoCurrency Trading Report – 24.09.2018 00:07

Hot news: These are the changes of the CryptoCurrency market in the last one hour.

Bitcoin is now leading the rank on the most popular digital currency in the trade market. It has an increase of 0.05% in its exchange rate from 6689.215 dollars now at 6692.560 dollars. Tether is next to the leading crypto Bit..

The post Bitcoin $6692.560 – CryptoCurrency Trading Report – 24.09.2018 00:07 appeared first on CryptoCurrency Blog.

Top 5 Bitcoin ATM Locations in Athens for Fast and Easy Crypto Access

As a crypto analyst and frequent investor in the Greek digital currency market, I can confidently recommend Bcash for convenient and secure Bitcoin purchasing in Athens. With 10 strategically located crypto ATM hotspots spanning central Athens and the northern suburbs, Bcash enables instant access to leading cryptocurrencies like BTC, ETH, and USDT. Experience the Leading […]

The post Top 5 Bitcoin ATM Locations in Athens for Fast and Easy Crypto Access appeared first on CryptoNinjas.

Bitwise launching spot bitcoin ETF (BITB)

Bitwise Asset Management, the largest crypto index fund manager in America, announced today that the Bitwise Bitcoin ETF (BITB), the firm’s first spot bitcoin ETF, intends to begin trading today, January 11th. BITB will join Bitwise’s comprehensive suite of 18 crypto investment products, which currently includes five other crypto ETFs. “We expect significant demand for […]

The post Bitwise launching spot bitcoin ETF (BITB) appeared first on CryptoNinjas.

Cryptocurrency Payments for Insurance: Are Insurance Companies Really Embracing Bitcoin and Altcoins?

It is no longer unusual to hear that a bank accepts savings in Bitcoin, Ethereum, and the like. Or that a loan company helps businesses with crypto. After all, the traditional financial and insurance industries were among the first to adopt cryptocurrencies. The latter ones have found more than one way to incorporate these means of payment […]

The post Cryptocurrency Payments for Insurance: Are Insurance Companies Really Embracing Bitcoin and Altcoins? appeared first on CryptoNinjas.

4 Things We’ve Learned About Owning Bitcoin in 2023

For some people, the word bitcoin still triggers an eye-roll, but by now, most of us know that cryptocurrency is here to stay. With that in mind, it’s a good idea to make sure you’re clued up and well-educated on the topic, especially if you’ve ever considered investing yourself. However, with so much misinformation floating […]

The post 4 Things We’ve Learned About Owning Bitcoin in 2023 appeared first on CryptoNinjas.

Fuse Network welcomes Liquify as new blockchain infrastructure partner

Today, Fuse Network, an enterprise-grade, use-case agnostic, decentralized EVM-compatible public blockchain, announced Liquify as its newest remote procedure call (RPC) provider and ecosystem partner. Liquify will provide public RPC services – both free and private. RPC nodes help process requests from decentralized applications (dApps). They are vital for improving the usability of web3 and for […]

The post Fuse Network welcomes Liquify as new blockchain infrastructure partner appeared first on CryptoNinjas.

BITmarkets – Spot, Futures, Margin Trading with 150+ Cryptocurrencies

Welcome to the world of BITmarkets – a leading cryptocurrency exchange offering a wide range of trading options for both retail traders and corporate clients. In this comprehensive review, we will explore the various features and services provided by BITmarkets, including spot, futures, and margin trading. Whether a seasoned trader or just starting your cryptocurrency […]

The post BITmarkets – Spot, Futures, Margin Trading with 150+ Cryptocurrencies appeared first on CryptoNinjas.

Hong Kong’s first licensed crypto exchange HashKey is now live

HashKey Exchange, the first licensed retail virtual asset exchange registered in Hong Kong, announced its official launch today. Together with executives from the HKSAR government, top-tier banks, insurers, and Big 4 auditing firms, HashKey held the grand launch in Hong Kong. Strictly adhering to the SFC’s user registration and KYC requirements, the HashKey Exchange platform […]

The post Hong Kong’s first licensed crypto exchange HashKey is now live appeared first on CryptoNinjas.

Adenasoft launches new crypto exchange white label solution: ACE

Adenasoft, a South Korea-based IT/software company, has just announced the launch of ACE, their new SaaS product designed for cryptocurrency exchanges. ACE fully prepares businesses for exchange operations quickly, taking less than a month to get up and running. ACE offers a comprehensive suite of features that enables crypto exchanges to streamline their operations and […]

The post Adenasoft launches new crypto exchange white label solution: ACE appeared first on CryptoNinjas.

Maximize Your ETH Investment: The ETHphoria Vault by Pods

This week, the team of Pods, a provider of structured products for crypto assets, unveiled its latest offering – the ETHphoria Vault. This innovative yield strategy is designed explicitly for ETH enthusiasts who are bullish about its future prospects and want to earn even more from increasing prices. ETHphoria is a low-risk, principal-protected strategy designed […]

The post Maximize Your ETH Investment: The ETHphoria Vault by Pods appeared first on CryptoNinjas.

Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet

The team of Pods recently announced the mainnet launch of its 3rd strategy on Pods Yield: FUD Vault, which now complements ETHphoria and stETHvv. FUD Vault provides a way for users to benefit from market downturns by offering a mechanism to hedge against significant price drops in ETH while preserving the deposited principal. Who is […]

The post Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet appeared first on CryptoNinjas.

What is DeFi Returns? A new way of DeFi Investing

DeFi Returns brings comprehensive up-to-date information on DeFi strategies and protocols, to easily compare and analyze their performance. Getting the most reliable data source for historical yield on DeFi, to help users make informed decisions when investing in the ecosystem. All data displayed is sourced from the protocol’s smart contracts directly. The new DeFi Returns […]

The post What is DeFi Returns? A new way of DeFi Investing appeared first on CryptoNinjas.

RockX broadens suite with launch of new ether (ETH) native staking solution

RockX, an Asia-based institutional-grade staking services provider, announced today the broadening of its staking product suite with the addition of a new ether (ETH) native staking solution. This latest offering strengthens RockX’s position as a comprehensive provider of diverse staking needs, maneuvering quickly to the evolving crypto market landscape. Navigating the Ethereum ecosystem presents institutions with […]

The post RockX broadens suite with launch of new ether (ETH) native staking solution appeared first on CryptoNinjas.

The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets

Hex Trust, a regulated institutional-grade crypto-asset custodian, today announced it has partnered with The Sandbox, a leading decentralized gaming virtual world to enable fully-licensed and highly-secure custody of assets such as LAND in The Sandbox’s metaverse. The partnership sees Hex Trust fully integrate LAND into its custody platform, Hex Safe, which supports cryptocurrencies, security tokens, and NFTs. […]

The post The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets appeared first on CryptoNinjas.

CoinFlip launches new self-custodial cryptocurrency wallet platform ‘Olliv’

CoinFlip, a bitcoin ATM and crypto services company, announced today a new offering with the launch of ‘Olliv,’ a self-custody-powered crypto platform. The Olliv platform provides a frictionless way to buy, sell, send, receive, and swap cryptocurrency securely stored on a self-custodial wallet, removing the uncertainty of unknown third-party custodians. By leveraging CoinFlip’s existing network […]

The post CoinFlip launches new self-custodial cryptocurrency wallet platform ‘Olliv’ appeared first on CryptoNinjas.

Crypto derivatives exchange Deribit to launch zero-fee spot trading

Deribit, a popular cryptocurrency derivatives platform, has announced the launch of zero-fee spot trading, allowing clients to buy and sell crypto while simultaneously managing risk using other derivatives. Spot trading will start on April, 24th 2023 at 1 PM UTC with three pairs (BTC/USDC, ETH/USDC, and ETH/BTC), providing clients with a simple and free solution […]

The post Crypto derivatives exchange Deribit to launch zero-fee spot trading appeared first on CryptoNinjas.

Nomura’s Laser Digital invests in Infinity, an Ethereum-based money market protocol

Japan-based banking giant Nomura, announced today that its digital assets subsidiary, Laser Digital, has made a strategic investment in Infinity, a non-custodial interest rate protocol built on Ethereum. Infinity’s wholesale exchange, the first of several planned infrastructures, provides inter-exchange clearing, fixed and floating rate markets, as well as enterprise-grade risk management utilizing hybrid on-chain/off-chain infrastructures […]

The post Nomura’s Laser Digital invests in Infinity, an Ethereum-based money market protocol appeared first on CryptoNinjas.

ETH infrastructure platform Blocknative adds TX bundles, cancellation, and replacement support

Blocknative, a real-time Ethereum (ETH) infrastructure platform, has newly introduced features including transaction bundle send, cancellation, and replacement support for the Blocknative Builder. Searchers can now submit MEV bundles privately to the Blocknative Builder to be included on-chain. This market utility builds upon Blocknative’s reliable, real-time infrastructure that is systematically important to the Ethereum ecosystem. […]

The post ETH infrastructure platform Blocknative adds TX bundles, cancellation, and replacement support appeared first on CryptoNinjas.

Crypto derivatives exchange Deribit to put in place trade surveillance platform from Eventus

Eventus, a provider of multi-asset class trade surveillance and market risk solutions, announced today that cryptocurrency derivatives exchange Deribit has chosen the firm’s Validus platform to provide market abuse monitoring on the exchange. Headquartered in Panama City, Panama, Deribit is one of the largest cryptocurrency options exchanges by volume and open interest, with approximately 90% […]

The post Crypto derivatives exchange Deribit to put in place trade surveillance platform from Eventus appeared first on CryptoNinjas.

Crypto exchange Gemini launches new electronic OTC trading solution

Gemini, the popular bitcoin & crypto exchange company, today announced the launch of electronic over-the-counter trading (eOTC), an automated crypto trading solution designed for institutions. The Gemini eOTC solution offers a variety of advantages to institutional traders including: Competitive Pricing & Execution: Liquidity is sourced from top-tier liquidity providers with deep liquidity pools, enabling counterparties […]

The post Crypto exchange Gemini launches new electronic OTC trading solution appeared first on CryptoNinjas.